Vietnam: Is the big bail-out really helpful?

03-05-2013

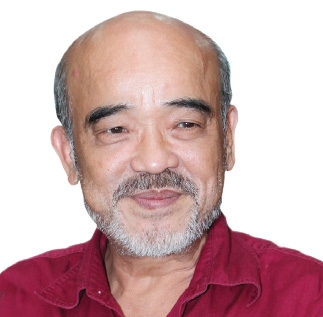

However, former Deputy Minister of Natural Resources and Environment Dang Hung Vo argues that such a bail-out cannot cure all businesses and time will provide the best answer.

Recently the public has been stirred by the government’s VND30 trillion ($1.44 billion) credit package bail-out, which is eagerly awaited by property investors. This bail-out has become a controversial topic, with some saying the local property needs to be rescued for many reasons, while some disagree, even saying that the market should be allowed to fall freely.

|

But I think the word “rescue” should not be used and should be replaced by the phrase “impact on the market when it is in difficulties.” In principle, some countries like the US, Thailand and Singapore previously rescued their difficult property markets. But these countries only did this when the property market caused a financial crisis or economic crisis. They “rescued” the property market due to aftermath it caused, not for the market itself.

At present, the property market has yet to have any bad impacts on the economy and the financial market, but to some property enterprises only. I would like to repeat that the problem of saving the property market must be considered only when this market’s difficulties drive the economy into a crisis.

It is unreasonable for one to call for the government’s help when he suffers from a loss in his business. The market is an “economic game” at which all players must obey rules. He can enjoy his gains and must accept his losses at this game.

Some say that a recovery of the property market will induce increases in consumption of nearly 100 types of goods like construction materials, furniture or consumer goods. But I think that such consumption increases are not important. The most important thing now is that the economy is falling into stagnancy and an economic stability remains a prime priority.

Property closely pertains to the financial market as it is always home to a great deal of capital. Thus some certain consequences can arise in the wake of property difficulties. Therefore, we have to find out which bottlenecks are when the property market faces difficulties. Now, some property enterprises are bogged down in great difficulties, and the government has applied some assistance packages plus some solutions like reductions in taxes, land rentals and rescheduling the timeline for paying land rental. These have help enterprises lessen financial burdens.

The $1.44 billion bail-out is not for supporting all property enterprises, but for consumers and enterprises developing low-income housing projects and cheap-priced social housing projects. This bail-out also manifests the government’s big efforts. Accordingly, beneficiaries can seek loans with an annual lending rate of 6 per cent, instead of 25-26 per cent previously.

At present, there are no accurate data about property inventories, the number of enterprises in need of supports and the number of people needing to buy cheap-priced houses. Meanwhile, the Ministry of Construction’s statistics show that Hanoi and Ho Chi Minh City have an inventory of about 20,000 houses, but the Dragon Capital investment fund said the figure was up to 70,000.

Many have questioned why the value of the bail-out is VND30 trillion. I have answered that there is no basis for an exact figure and this VND30 trillion reflects the government’s biggest efforts. Vietnam often proposes a certain figure, which then can be adjusted based on developments. This bail-out’s aim to increase low-income people’s buying power is quite correct and can help ensure social security and improve the market’s transactions.

It is also necessary to reconsider supporting enterprises in details, even whether such support is really needed to not. If necessary, such support must be implemented transparently and fairly.

The psychology in waiting will greatly affect the recovery of the property market, because half of the market’s recovery depends on psychology. At present, end-users remain unready to buy houses, while enterprises are worried about the future of their projects, due to too many different forecasts. Some say prices will continue declining, while some say prices will not.

When one feels that prices have fallen to the lowest level and his confidence in the market returns, he will stand ready to invest. The bail-out will lessen the market’s difficulties, but cannot help revitalize the market. It would take time for the market to flourish again.

Actually, the bail-out should not be considered an elixir, but a financial solution to increasing transactions for a stagnant sector. We also should not expect that such a bail-out will give the property market a breakthrough. VND30 trillion is not a big sum. It can partly warm up this market but cannot give a big impetus for reviving the market. If we want to remove its stagnancy, the government had better establish a company in charge of trading distressed properties.

Many have also been questioned about the transparency of the bail-out. Frankly speaking, almost all policies have differences between documents and reality. For example, the state has been trying to ensure resettlement houses for those whose land has been reclaimed by the state, but such houses have often been sold off by these people. They sell these houses to a speculator who after that market these houses. It is clear that though the policies are not aimed to do this, but reality will be reality, because there has been a lack of transparency in such policies, plus corruption.

The property market is currently in the wiat-and see situation psychologically, but I think we should not be worried so much about this. The market has its own rules and people may have to continue waiting for several years more, which will be the time for restructuring. Given the existing market condition, it is “irresponsible” if we force people to pin more confidence on the market. The bail-out will not be able to change the market’s law and lessen people’s waiting. In fact, no miracle can save the current property market.

Some have asked me how the property market will change thanks to the bail-out, I reply that it would be difficult to make any forecast and time would be the best answer.

It is impossible to make an accurate forecast because all data about property inventories, bad debts and property’s real financial health remain unclear. And the market now is home to too many different forecast. As a result, it is also very difficult to know how much will be exactly needed to support the market, how many enterprises on the brink of bankruptcy, and people’s demand for houses.

I am only sure that such VND30 trillion is too little for melting the stagnant property market based on minimum data.

Often when a property market falls into a crisis, it would take five or six years to see signals of recovery. At present, Vietnam’s property market does not need any “saving” and signals for recovery may come sooner. Let’s look back to 2009 when the government tried to curb inflation, but high consumer price index rebounded strongly in 2011. Then the government had to continue reining in inflation. In another case, though knowing that there will be an increase in inflation if we raise prices of fuel and power, we still have to lift such prices. The same is true to property. It will need time to recover and no miracle can revive it immediately.

http://vir.com.vn/news/en/property/is-the-big-bail-out-really-helpful.html